Why Work with a Local Expert When Buying or Selling in Central Alabama Buying or selling real estate in Central Alabama is more than a financial decision—it’s about choosing the lifestyle, community, and long-term stability that fit your goals. From Birmingham and Hoover to Prattville, Millbrook, Wetumpka, Montgomery, and the surrounding areas, Central Alabama offers a blend of thriving suburbs,...

Real Estate

The temps are falling, interest rates are still higher than we would like them to be, and the holidays are approaching fast! You have been contemplating selling your home but with these and possibly other objections - you simply are not sure that this is the right time to attempt to sell your home. Even if this is the case - I would encourage you to reach out by call or text at 334-799-1698 and let's...

In any real estate transaction, Trust is a Must! It does not matter if you are looking to sell or purchase a home or piece of property - TRUST is everything. It is important to trust the REALTOR you are working with from Day One because you are looking for a smooth and stress free transaction. You do not want any surprises and the transaction being completed in a timely matter means everything. I want to...

Using a REALTOR to assist you in the purchase or sell of your property can sometimes seem intimidating. At this point - if you do feel this level of intimidation - you are not partnered up with the "right REALTOR." There should really be no real intimidation and for that matter - no negative feeling at all engaging with a REALTOR, at least the right REALTOR for you. Ultimately - the REALTOR who is right...

Building a brand new home can be a very exciting aspect of homeownership! However, this can come in two different ways really. The first option is to build a new home in a pre-planned subdivision. The second option is building a custom home on your own piece of property. The differences are many but I will highlight some right now. Building in a pre-planned subdivision would often take about 4-6 months...

We may still be in the middle of the Winter, but the real estate market is heating up. Just like the two clients I have just helped - you can close on your next home sooner than you think! Interest rates may be a little bit higher than we would prefer them to be, but there are other negotiating tactics that can help you secure the best deal possible and be in your next and NEW HOME before the Summer...

Building a New Home and The Home Buying process in general - have A LOT of similar characteristics.When building a New Home - the first and most important task here is the proper construction of the foundation. The foundation is rarely thought about from this point forward - unless of course, there is a problem with it. All of the - Next Steps - the framing, the brick work, the flooring, the well designed...

Owning property in a state that you do not live can be tricky. Purchasing or selling property in a state you do not live can be even more tricky. If this is you - we should talk. The purchase or sell of real estate in Alabama is an easy task no matter where you live. The key is constant communication. This will ensure that your purchase or sell is as seamless as possible and also that either you get the...

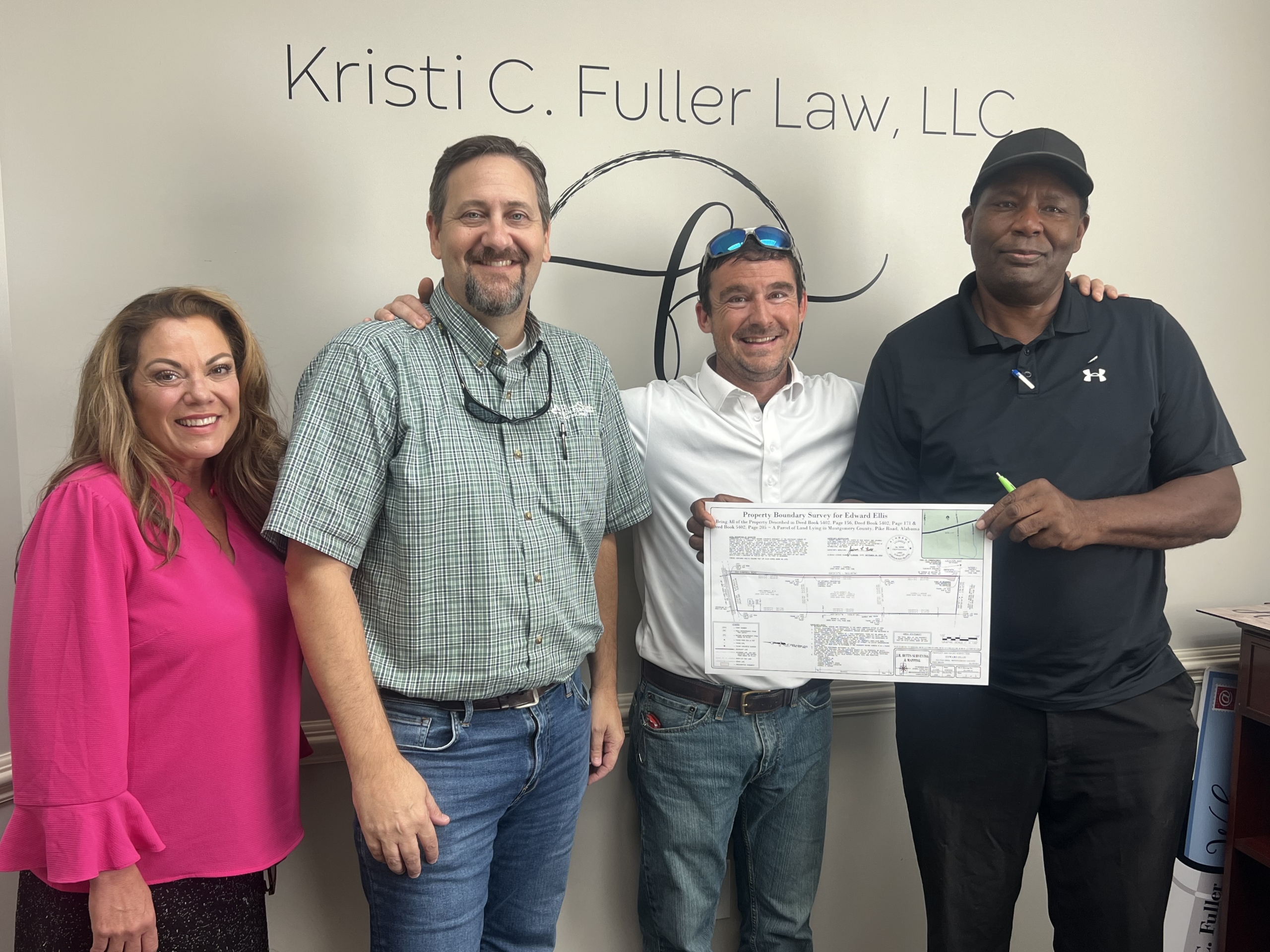

Real Estate transactions come in many types. No matter what — any and every real estate transaction you are involved in should have at the focus — RELATIONSHIPS!!! It may be a first time home buying opportunity — it could be a vacation home — it may be a recreational tract of land, but no matter what — RELATIONSHIPS are key! You are getting ready to make a move and equally important, AN...

In today's real estate market and with the abundance of technology, sellers and buyers alike have tools available 24/7 at their disposal and often times at little to no charge to the buyer/seller. The topic of REALTOR commissions is one that is often discussed and because of the tools available, especially to the sellers - the idea of not using a REALTOR and simply marketing your home as FOR SALE BY OWNER...